The Hidden Benefits of Retaining Your Buy-To-Let Property: A Smart Investment Move!

While demand for rental property is currently at an all-time high, it's worth noting that the number of landlords planning to sell their properties has also reached a record high. This may seem contradictory, but let's break it down.

In simple terms, the rationale behind Buy To Let is to buy a cash-generating asset. By utilising the income to cover the borrowing and capital appreciation, you create an opportunity to repeat the process. Over time, money loses value due to inflation. What could be bought with £1 five years ago may not be affordable today. That's why investing in buy-to-let property should be a long-term commitment rather than a short-term endeavor.

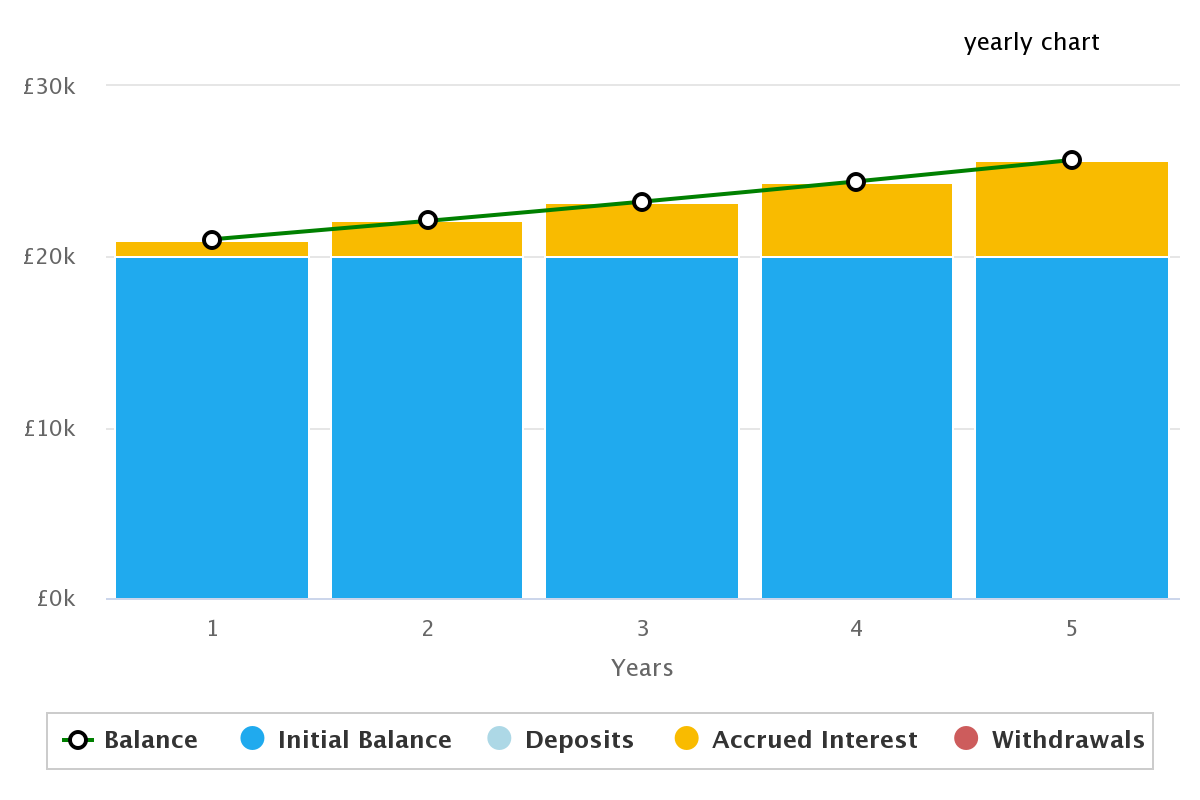

Consider this example: If you bought a property for £50,000 in 2000 and it is now worth £150,000. Selling it would result in a profit of £100,000. However, after taxes, mortgage repayment, and fees, you would be left with less than £20,000. By keeping the property, a mere 4% increase in value over the next five years would match the return you could generate from a bank saving account. Plus, you would still own the underlying asset.

Of course, everyone's situation is unique, and selling might be the right decision for some individuals. But it's crucial to weigh the potential costs and lost gains before making any moves. Property remains an excellent investment, despite the uncertainties. That's why it's essential to have a well-considered long-term strategy and explore all options to maximise the benefits of your investment.

If you would like to talk to us about your specific investment decisions, we would be happy to help. Get in touch with our lettings team today.

Subscribe to our Newsletter

Get the latest news from Brand Vaughan direct to your inbox.

Unsubscribe at any time. For more about how we use your information, see our Privacy Notice.